If you are looking for a sure-fire way to save money while travelling, the Wise Debit Card is a must-have. I’ve been using Wise (formerly Transferwise) to transfer money between bank accounts in different currencies for a couple of years, and I swear by it. But the addition of personal debit cards as well as their original business debit card makes this the best travel debit card by a country mile.

Why Wise Debit Card is cheaper than banks and credit cards.

The reason Wise can exchange currencies cheaper than your bank is that they process so much volume they acquire (formerly Transferwise) real-time foreign exchange rates without the markup your bank charges for the privilege of exchanging currencies.

Think of it this way – every moment there is a market between two commodities. The amount you are buying another currency (for example, the Indonesian Rupiah) and the rate someone else (your bank) is willing to sell that Rupiah. Your bank charges a fat margin – Transferwise has lower margins – therefore you get more Rupiah for your Dollar.

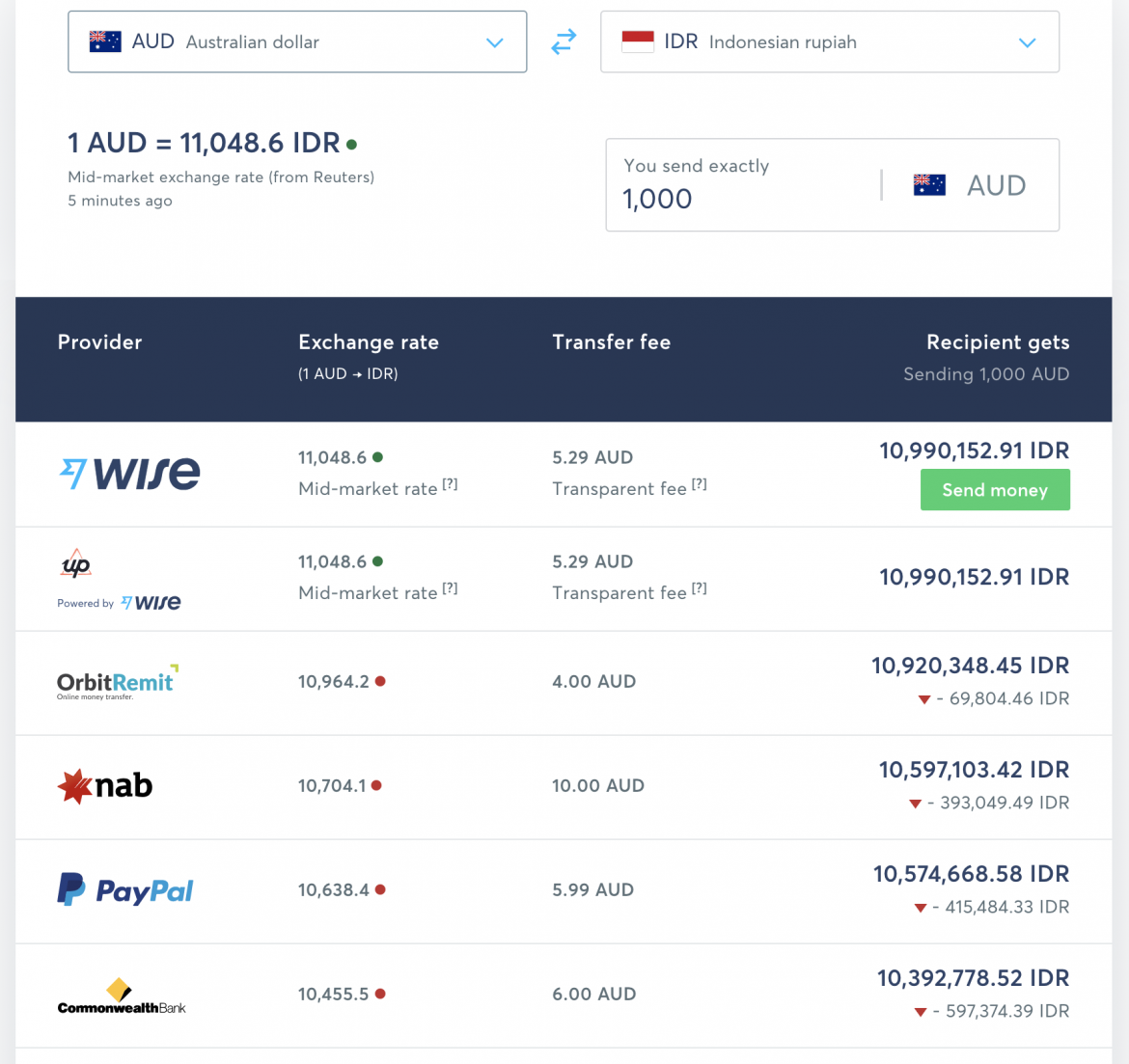

Check out the screenshot below showing the transfer of AUD$1,000 using Wise compared with NAB, PayPal and Commonwealth Bank.

The difference can be as much as IDR600,000, which is around AUD$60. The currency in Bali is the Indonesian Rupiah (IDR), and let me tell you, AUD$60 goes a long way in Bali.

Using Wise for sending money from Australia to Bali.

Many Australians have friends and family in Bali and need to send money from Australia to a Bali bank account.

Let’s use an example of sending AUD$100 from your Australian bank account to a friend’s bank account in Bali. Remember, the currency in Bali is the Indonesian Rupiah (IDR).

First, you register your own personal Wise account. Register on a desktop or laptop first, then download the smartphone apps for Android and Apple.

It’s very easy to confirm your identity (required by law, same as any Australian bank) using a passport or driver’s license, but the verification process is quite quick.

Next, you create a new Australian bank account complete with BSB Code and Account number. This account behaves exactly the same as any of your other Australian bank accounts. Now you have the new account number, it’s dead easy to transfer money from your current local bank account to your new Wise bank account.

So now you have an account within Wise in Australian Dollars. Next, you use the menu options to open an IDR balance. The difference between a balance and an account is that a balance is simply holding a foreign currency without a bank account attached to it — an account is a proper bank account with account numbers.

Now here is the fun bit — you can send IDR to your friend’s Indonesian bank account. All you need is the name on their account, the name of the bank and the account number. This makes it almost impossible to make a mistake and send it to the wrong person because the confirmation screen will display the name of the account holder, which you can check against the details they provided you.

Once confirming the transfer, you can track its progress online and also receive email notifications when it arrives in their account.

The difference when transferring from your bank directly to a foreign bank is huge.

- You get charged an “administrative fee”, usually around $20-50.

- The exchange rate they transfer your money is the retail rate, meaning they are making a significant margin off you.

- A “delivery” fee is often charged. The recipient’s bank is literally charging them for receiving the funds being transferred.

Wise cuts out the middle-man, in this case, your bank, and withdraws the money from your account (without fees), exchanges it for the destination currency (which is where you save the most) and deposits it in the recipient account for a tiny fraction of the fee that your bank would charge.

The Wise Travel Debit Card.

If you apply for a Wise Debit Card, you can use it to spend Indonesian Rupiah while in Bali without any transaction fees at all.

Think about this. You go to dinner in a restaurant in Seminyak and in a fit of generosity pay the bill for your four guests. Maybe drinks and dinner come to IDR 4,000,000.

Using the rates in the above example, you will be charged around AUD$360 if you pay with your Visa or Mastercard. The bank decides what exchange rate it will charge you in Australian Dollars, and let’s be frank – the rate isn’t great.

On top of that they may charge you an “overseas transaction fee” because, well, they can. That’s just another bank tax. Since the consumer commissions in several countries made “overseas transaction fees” against the law, most banks simply sneak it in with an even worse foreign currency conversion rate.

Either way, they get you, and you end up paying a lot more than the original IDR4,000,000 bill.

I cannot thank you enough for this tip

I cannot thank you enough for this tip. I have used Transferwise in BALI last week and it worked perfectly without the horrible australian banks fees. also, it’s so easy to withdraw money from the many ATM’s around and I must say that I am now using it in Australia if and when I need to transfer money abroad. Best tip ever.

With a Wise Debit Card, you pay… Rp 4,000,000 for dinner. No extra fees, no transaction charges. That’s because the money you are holding in your IDR currency is used to pay just like a local would using their Indonesian debit card.

And the best feature is that whenever you make a transaction you get an alert on your smartphone telling you where the transaction was made and how much. That means whenever I use it (and I make several transactions a day) I get an instant confirmation showing the local currency transaction.

Not only does this give me a great sense of security but I can also confirm how much is left in the local currency account where I’m travelling.

Withdraw Local Currency with your Transferwise Debit Card

Other than using the card for purchases without any transaction fees while you’re on holiday in Bali, you can also withdraw cash from ATMs in Bali as well.

That means you don’t need to bring cash to exchange at a money changer or get hit with exorbitant bank fees by using your existing Visa or Mastercard.

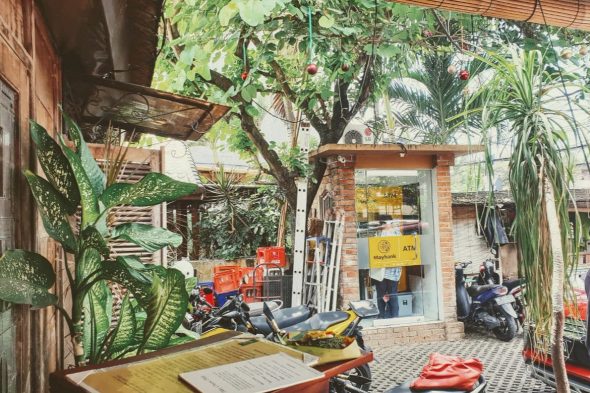

Not all ATMs will accept the Transferwise Debit Card but many do — I’ve found several around Bali that allow cash withdrawals, with my favourite being the yellow-coloured Maybank (there’s one outside Biku in Seminyak).

No leftover foreign currency at the end of the holiday.

One of the biggest pains when travelling is using up the local currency before you leave. Or conversely, for me, it’s not having any when I land in a new country.

Using the Transferwise smartphone app I can move money between currencies at the most competitive rate on the market. Which means if I’m a bit short because of a big splurge with a few days to go, I can exchange money from one of my other currency wallets into the local currency.

And when leaving, or anytime after I leave, I can move the leftover money into the currency I’m going to use next. Because the rates are better than I can find anywhere else, the stress of getting a horrible exchange rate for small or large amounts is no longer a factor.

It’s just one less friction point when travelling, so I can focus on making my Indonesian Rupiah, Vietnamese Dong, Malaysian Ringgit or Euro go further.

Save money by spending local currency during airport transits.

One of the pains of travelling far and wide is the transit times while changing flights at foreign airports. There’s not enough time to get outside immigration, but enough time that you may want some food or drink (always a good idea), or check-out the local airport shopping (never a good idea).

The problem is you don’t have any local currency, and using the currency exchange booths means paying either a commission or a shockingly expensive exchange rate, especially for small amounts.

My solution is to figure out what I’m going to get (usually food or drink while waiting for my connecting flight) and transfer that amount using my Transferwise smartphone app and then paying for it using my Transferwise Debit Card.

That way I get the most competitive rate even with small amounts, and paying for it using my card means it’s being transacted in the local currency.

So buying a laksa at KLIA doesn’t mean paying my credit card issuing bank an “overseas transaction fee” along with a grossly uncompetitive exchange rate. The last time I tested the difference I paid 54% more than I would with my Transferwise Debit Card using local currency. An AUD$8.20 curry turned into a $12.67 charge on my credit card.

And if you doubt this, or have had a similar experience, please leave a comment below.

Saving for a holiday made easy.

We all know that saving for a holiday is hard work. And when you go to change your hard-earned cash into the local currency you are at the whim of the prevailing exchange rate.

What I do is transfer money from my home bank account into my Transferwise Debit Card account and regularly exchange those dollars into my destination currency.

For example, for a holiday to Vietnam, I transfer a few hundred dollars a month into my Transferwise account and then swap those dollars for Vietnamese Dong regularly. That way I’m averaging the exchange rate over a length of time – which means I won’t get the best rate or the worst rate – but an average rate over the time I’m saving for the trip.

So there it is. Put funds into your Transferwise account, change it into any currency you like, and spend like a local. You can try it out by getting a Transferwise account, connecting it with your own bank account, putting in a small amount to try it out (that’s what I did) and testing the exchange rate by using the same amount as a foreign exchange transaction using your own own Internet banking, or asking for an over-the-counter transaction at your local bank branch (like that’s somewhere we go any more).

While most anyone can open a Transferwise account, Debit Cards can only be issued to residents of certain countries.

Disclaimer: Using the links from this website means I get a very small commission from anyone who signs up for a Transferwise account and makes a currency conversion. I’ve been using Transferwise for over two years and I love it. Ask any questions in the comments section below.