Nothing ruins a holiday faster than losing your hard-earned cash or having your card swallowed because you made a simple but avoidable mistake. Using your credit or debit card in Bali is quite safe if you follow these Rules for Withdrawing Money at ATMs in Bali. From using ATMs at the airport, to which ones to avoid, read this and you will know everything you need to about using your card in Bali to withdraw cash.

The banking system in Indonesia is quite sophisticated. For locals, you can pay bills like electricity, mobile phone top-ups, and even airfares if you don’t have a credit card, which is the case for the majority of the local population. The currency in Bali is the Indonesian Rupiah (IDR).

If you are looking for a friction-free holiday, bring your ATM card and use it with confidence like you would at home, but read these tips to keep from being scammed.

1. Withdraw money from ATM at Bali airport.

Bali airport recently completed several new upgrades to the arrivals hall following the recent APEC meetings, and those included installing brand new banking facilities.

After clearing immigration, but before the chaos that awaits you when getting transport, on the immediate left after exiting customs are some bank branches. While the banks are not open 24 hours a day (they’re opening hours seem to change) there are also ATMs that are completely safe to use to withdraw money.

Unlike other international airports in South-East Asia, these are not independently operated — which is a good thing because independent ATM providers charge outrageous fees — but are all owned and operated by major Indonesian banks. This means you are completely safe using the ATMs at Bali airport to withdraw local currency (the Indonesian Rupiah).

If the bank branches are open you can use them with complete safety to change your local currency to the Indonesian Rupiah. Although the rate will be slightly higher than local money changers the difference really is so small (less than 1%) as not worth worrying about.

Not only are they super convenient but they are completely trustworthy, so load up on Rupiah when you arrive.

2. Use ATMs attached to a major bank branch.

The best ATM’s to use are ones located in the foyer of a major bank. Brands with many locations in Bali include BNI, BRI, BCA, CIMB Niaga and Bank Mandiri. These all have 24-hour security guards posted so the chances of these ATM’s being compromised are nil.

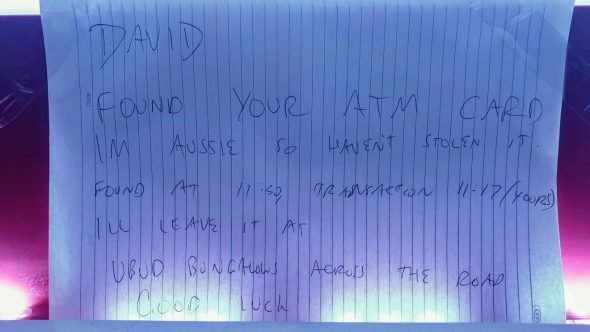

Pro Tip: Some ATM’s deliver your cash first, and then your card. For those people who come from countries where the ATM spits out your card first and then the cash, like Australia and New Zealand, this can easily lead to collecting the cash and forgetting about your card, which often takes up to 10 seconds to dispense.

I’ve made this mistake twice (maybe I’m a slow learner), and on one occasion I returned to the ATM an hour later to discover that some kind soul had placed my card on top of the ATM. How’s that for a random act of kindness!

I was withdrawing cash from an ATM in Ubud recently and discovered a note left by the previous user. What an incredibly nice thing to do!

Some ATM’s will also ask if you want to change you PIN — which you don’t want to do — and you will need to use the “cancel” button to get the machine to return your card.

Most ATM’s will automatically swallow a card that is left in the slot for too long. The only way to retrieve this is to visit the branch during opening hours and explain your temporary act of forgetfulness, making sure to take your passport with you.

Take your time and make sure you select English from the menu options at the start of the transaction. Most ATMs offer English and Indonesian as the only language options.

3. Use branded stand-alone ATMs.

The next best option is a stand-alone ATM from one of the major local banks described above and look like the photo below. I recommend BNI for their large number of locations, relatively new installations and convenient locations. They seem to be serviced more frequently than other banks and are kept in cleaner condition and better working order.

They can often be found located in the same compound as service stations making them easy to spot. The trick here is to forgo any ATM booths that look old or dodgy.

Most banks will charge a convenience fee for using an ATM overseas of between $2 – 5 per transaction, as well as the less-than-competitive exchange rate. Therefore maximising each cash withdrawal is the best option.

The best travel advice about money ever!!

I went to Bali last year and had my card swallowed and now I know why!! About to go on my second trip with the girls and you have the best travel advice about money ever!! I always thought some of those ATMs were dodgy but now I know it's ok to get money from the airport or from one at a bank.

4. Don’t use ATMs located in convenience stores.

Just don’t. Choose not to.

I have an inherent distrust of ATMs located inside convenience stores for a bunch of valid reasons. They tend to be independently owned and operated, which means they often sock you with higher than expected transaction charges. ATMs owned and operated by the banks don’t charge as much.

They tend to be the targets of fraudulent activity like the installation of skimming devices, and don’t think that the presence of a security guard is any guarantee either.

They are also the kind of target-rich environment that attracts the unsavoury side of Bali. Anyone looking to scam tourists flock to convenience store ATMs like flies to honey. Late at night can be a problem with so many people hanging around, especially at night, looking for an opportunity from the “tired and emotional” late-night crowd who may be intoxicated and therefore likely targets.

Micro cameras have been known to be placed in convenience stores as a way of watching for your PIN, which combined with your wallet being lifted means the thieves have immediate access to your funds.

5. Don’t use Commonwealth Bank ATMs in Bali.

People are naturally drawn to brand names they know (and therefore trust). But when I encounter someone who has had their card swallowed they are surprised when I ask “was it a Commonwealth Bank ATM?” Be smart. Use local banks ATM’s.

You want to avoid non-local bank ATM’s, particularly those from Commonwealth Bank. They suffer from a lack of local support and have more problems than with locally-run bank ATM’s. They also have the highest “per transaction” charge of all the ATM’s in Bali. Brand recognition comes at a cost, and in Bali that cost is often upwards of $5 on top of other transaction fees.

If you are unlucky enough to use one of these ATM’s and your card is swallowed it often happens after the transaction has been processed, which means you’ve lost your money and your card, so call your home bank immediately to start the process of reversing the transaction. Or you could just not use these machines.

6. Go inside the bank for large transactions.

ATMs in Bali tend to have relatively low withdrawal limits of under 2.5 million Rupiah. That equates to around AUD$240, EUR155 or USD$175. Because of these low withdrawal limits, you may be tempted to conduct multiple transactions to top up that holiday spending cash, but each time you do you’re hit with transaction fees from your home bank and the local one too.

It is far better to go inside a bank and change your money in a single larger transaction. Changing money in banks is easy, completely safe and secure and their rates, while perhaps not quite as good as using a money changer in Bali, are still quite competitive. The only real downside is they tend to structure their transactions that include a commission, which means the actual real resulting rate is slightly higher than the one advertised.

So if you need to make a large transaction, it is best to go inside a bank branch. Opening hours are generally 9 am – 4 pm, although many close at 3 pm. Things can get very crowded around lunchtime, and especially in the afternoon, so I recommend going in the morning. If there is ever a good time to visit a bank branch in Bali it’s before 10:30 am.

See here for a map of ATMs and branches in Seminyak.

7. How to spot an unsafe ATM.

Skimmers were rife in Bali a couple of years ago, and although security has tightened up significantly, it still happens regularly. The chances of being skimmed if using ATMs inside a branch are essentially zero.

Some ATMs are not safe. Even the big banks get targeted by skimmers when the ATM is isolated enough. Use your common sense — if it looks dodgy, it probably is — so don’t use it. Skimmers use a couple of tools to obtain card details. A sleeve which captures the card details as it’s inserted into the ATM slot, and a camera used to look at the PIN being entered.

Take hold of the sleeve covering the card slot. If there is any movement then it may be a skimming device. Authentic sleeves are quite solid and don’t have a lightweight plastic feel to them.

Updated: Two Bulgarian national arrested by Bali Police for attempted skimming.

Check the enclosure for cameras. The banks will undoubtedly have their own, so don’t be concerned about them. Look for smaller, stuck-on digital camera pointed at an angle that can see the keypad. That’s the giveaway for thieves trying to record your PIN. Doesn’t look right? Then leave and use an ATM at a bank branch where security is solid.

Don’t use ATMs in isolated areas. Common sense really, but it must be said. If the area is dodgy then perhaps looking for an ATM isn’t your smartest move. Unsurprisingly the most hit ATMs for skimmers are dimly lit, with few customers and at ATMs that are clearly not provided by the major banks.

Most major bank ATMs are safe. If the ATM you are thinking of using looks like part of a national bank, brightly lit and clearly branded it’s 99% safe.

The ATMs with the brand you recognise from your home country? Not so much. They tend to have overpriced “convenience” charges and for some reason also tend to be the ones least guarded and most likely to be targeted by skimmers. Go figure.

8. Stock up on cash before public holidays and festivals.

In the days before the bigger public holidays and festivals, locals withdraw huge amounts of cash from the banking system. This invariably results in ATM’s running dry the day before public holidays, when, you guessed it, the banks are closed.

In later posts, I’ll document the public holiday calendar — which can be a bit of a moving target — but generally, you will know when a big public holiday is coming because the preparations are quite colourful and very obvious.

9. ATMs dispense only 2 dennominations.

Look for a sticker on ATM’s that indicate the denomination of notes available. They dispense only two denominations: Rp 50,000 rupiah notes (about AUD$5) and Rp 100,000 rupiah notes. The Rp 100,000 ones are best because $250 in Rp50k notes will make for a very thick wallet!

You can read more about the currency in Bali for an in-depth understanding of what notes are used and how much things cost.

10. Withdrawal limits on Bali ATMs.

The withdrawal limit on ATMs in Bali is usually between Rp 2,000,000 and Rp 2,500,000 (that’s around AUD$200-250) per transaction for machines dispensing Rp 100,000 banknotes and Rp 6,000,000 in total per day. However, that total is for local accounts. If using an overseas account the daily limit can be circumvented by using ATMs from different banks.

Your home bank will still dictate the maximum withdrawal limit (generally $300) irrespective of which ATMs you use, so be aware that if your transaction is declined it may be because you have already reached your limit if this is not your first withdrawal for the day.

You may want to read my article on choosing between cash or credit cards for your Bali holiday. And I highly recommend the Transferwise Travel Debit Card for managing your currency while travelling, which saves you money by having better exchange rates on purchases than your bank and doesn’t have any overseas transaction fees.

If using ATMs while travelling is not your thing, then there are plenty of money changers in Bali where you can change your cash for local currency.